Table of Contents

What are Form 15G and Form 15H?

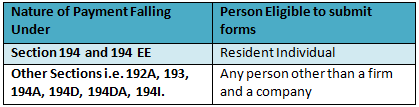

Form 15G and Form 15H are the forms prescribed under section 197A of the Income Tax Act 1961 which stipulates that if the recipient of the income provides a declaration in the prescribed form (form 15G and Form 15H) then no tax is to deducted under the following scenarios:

Person Eligible to Submit Form 15G and Form 15H

Form 15H is to be submitted by an Individual Resident of India who has attained the age of 60 years or more during the previous year i.e. senior citizens while Form 15G is to be submitted by other eligible assessees.

When to Submit Form 15G?

- Must be an Indian Resident (NRIs cannot submit form 15G).

- Any assessee, other than a company or a firm.

- Should be less than 60 years of age.

- Tax liability on the Total Income should be Nil for the Financial Year.

- The aggregate of the Interest received does not exceed the basic exemption limit for the financial year.

| Download Forms in | Form 15G | Form 15h |

| Word Format | Download Form 15G.doc | Download Form 15H.doc |

| Excel Format | Download Form 15G.xls | Download Form 15H.xls |

When to Submit Form 15H?

- Must be an Indian Resident (NRIs cannot submit form 15H).

- Must be an individual who has attained the age of 60 years or more (senior citizens or super senior citizens).

- Tax liability on the Total Income should be Nil for the Financial Year.

- The aggregate of the Interest received does not exceed the basic exemption limit for the financial year.

- Download Form 15H

When TDS is deducted on Interest Income?

TDS is deducted at the rate of 10% on the interest income earned on an investment in bank fixed deposits, recurring deposits, deposits in co-operative societies and post if the accumulated interest exceeds Rs.40,000 in a financial year (the earlier limit was Rs.10,000 for a financial year). For Senior and Super Senior Citizens, the threshold limit of TDS is Rs.50,000 for a financial year.

For any other deposits, the threshold limit is Rs.5,000. For example, if the interest earned from corporate deposits exceeds Rs.5,000 than TDS is to be deducted at 10% irrespective of any age.

Frequently Asked Questions related to Form 15G and Form 15H

1 Forgot to Submit Form 15G or Form 15H?

In case you forgot to submit or submit the form 15H or form 15G after deduction, to the deductor then you have to file ITR and ask for a refund.

2 Time to Submit Form 15G and Form 15H?

Ideally, you should submit the Form 15G or Form 15H along with the PAN card copy (failing which the deductor will deduct tax at 20%) at the beginning of the financial year i.e. within last week of April only, to avoid tax deduction.

Several complaints of deduction of TDS even after timely submission of respective forms have been registered with the banks, thus, RBI has directed and mandated banks to provide acknowledgment at the time of receipt of form 15G or form 15H.

3 What are the Penalties for Wrong Filing of Forms?

Any person making a false statement in the declaration shall be liable to prosecution under section 277 of the Income-tax Act, 1961, and on conviction be punishable:

- in a case where tax sought to be evaded exceeds one lakh rupees, with rigorous imprisonment which shall not be less than six months but which may extend up to seven years with fine;

- in any other case, with rigorous imprisonment which shall not be less than three months but which may extend up to three years and with fine.

4 Is it necessary to submit fresh from every year?

Every year fresh form 15G or Form 15H has to be submitted to each and every branch of the bank where you hold deposits.

5 Does the Form 15G or Form 15H need to be submitted to the Income Tax Department also?

It is the liability of the deductor to submit the forms to the Income Tax Department. Tax Deductor is required to provide a unique identification number to each form received during the financial year and prepare XML file using utility and submit it on a quarterly basis using Digital Signature Certificate to the Income Tax Department Online.

6 How to submit the forms aka mode of submission of forms?

Few Banks have started accepting Form 15G and Form 15H online. However, not all banks have started accepting online. So taxpayers need to ask the bank and submit online or manually as his bank permits.

7. Can Form 15G or Form 15H be submitted without PAN card?

No, you cannot submit form 15g or form 15h without PAN card. The Forms should be accompanied by PAN card copy else the tax deduction would be at higher rate of 20% instead of given rate of 10% under section 194A of the Income Tax Act.

8. Can form 15g or form 15h be submitted to avoid TDS deduction on all types of incomes such as contract income, professional fees, etc?

Form 15G or Form 15H are submitted only to avoid TDS deduction on the Interest of Securities, Dividend, Interest other than Interest on Securities (Bank/Company Deposits) , NSS, Interest on Units, Insurance Commission and Budget 2016 has provided that these forms can also be submitted to avoid TDS deduction on Rent. For other types of payments, these forms cannot be used.

Read All about GST on Real Estate in India

Practical Cases

Mr.Sanyam aged 32 years has the following income for the Financial Year 2018-19:

- Interest from Fixed Deposit from Bank of Baroda– ₹ 50,000

- Salary – ₹ 2,40,000

- Income from Other Sources – ₹ 30,000

- PPF Contribution – ₹ 50,000

- Standard Deduction – ₹ 40,000

Can he submit Form 15G to the Bank of Baroda?

Let’s see the following aspects:

- Tax Liability on Total Income: (₹ 50,000 + ₹ 2,40,000 + ₹ 30,000) – (₹ 50,000 + ₹ 40 000) = ₹ 2,30,000 i.e. the total taxable limit does not exceed the basic exemption limit of ₹ 2.50 lakhs.

- Aggregate Interest Income of ₹ 50,000 does not exceed the basic exemption limit of ₹ 2.50 lakhs.

Therefore both condition stipulated under section 197A are satisfied, hence Mr.Sanyam may submit Form 15G to the Bank of Baroda.

On the other hand, to submit Form 15H only the first condition needs to be satisfied, that is, the final tax liability on the estimated total income computed as per the provisions of the Income Tax Act should be NIL. The second condition imposed by Form 15G is not applicable in the case of Form 15H.

For example, Mr. Jain, 68 years old has the following incomes for the financial year 2018-19:

- Interest Income from Fixed Deposits – ₹ 2,50,000,

- Senior Citizens Saving Scheme – ₹ 45,000

- PPF Contribution – ₹ 50,000

- Standard Deduction – ₹ 40,000

Now, is he eligible to furnish Form 15H?

As pointed out earlier, all Mr.Jain has to do is to find out his final tax liability.

- Tax Liability on Total Income: (₹ 2,50,000 + ₹ 45,000) – (₹ 50,000 + ₹ 40 000) = ₹ 2,05,000 i.e. the total taxable limit does not exceed the basic exemption limit of ₹ 3 lakhs.

- Aggregate Interest Income conditions are not applicable for Form 15H i.e. the income sources are irrelevant for Form 15 H.

Since his tax liability is NIL, Mr.Jain is indeed eligible to furnish Form 15H to the bank.